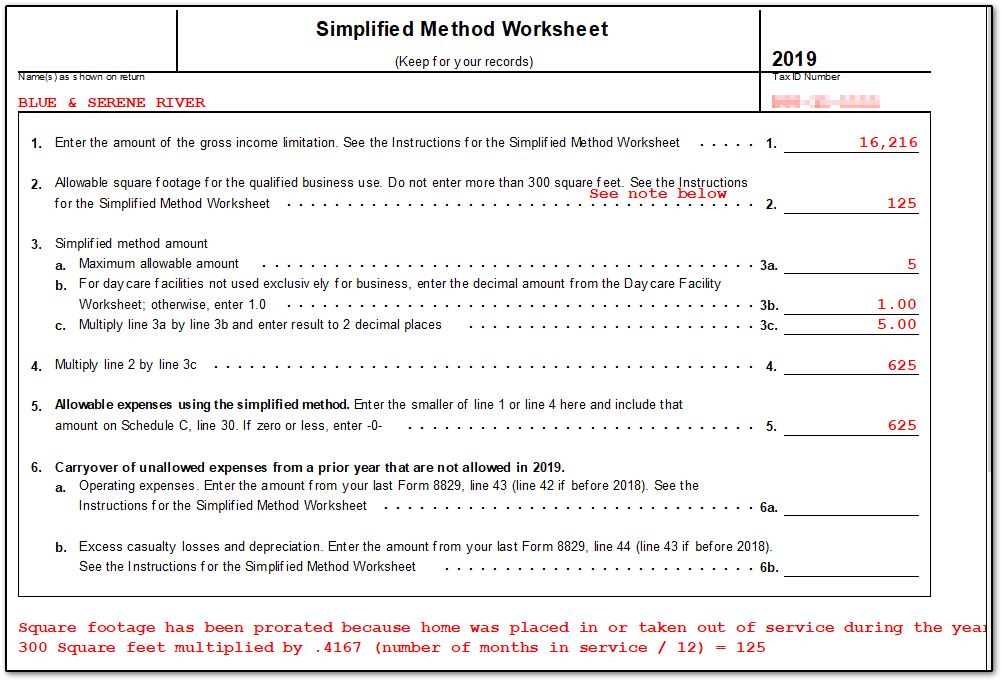

Simplified Method Worksheet 2019

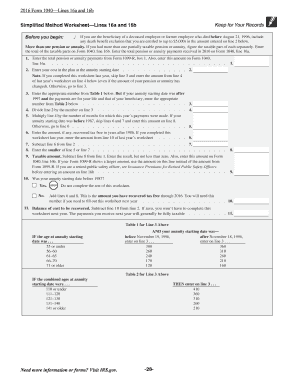

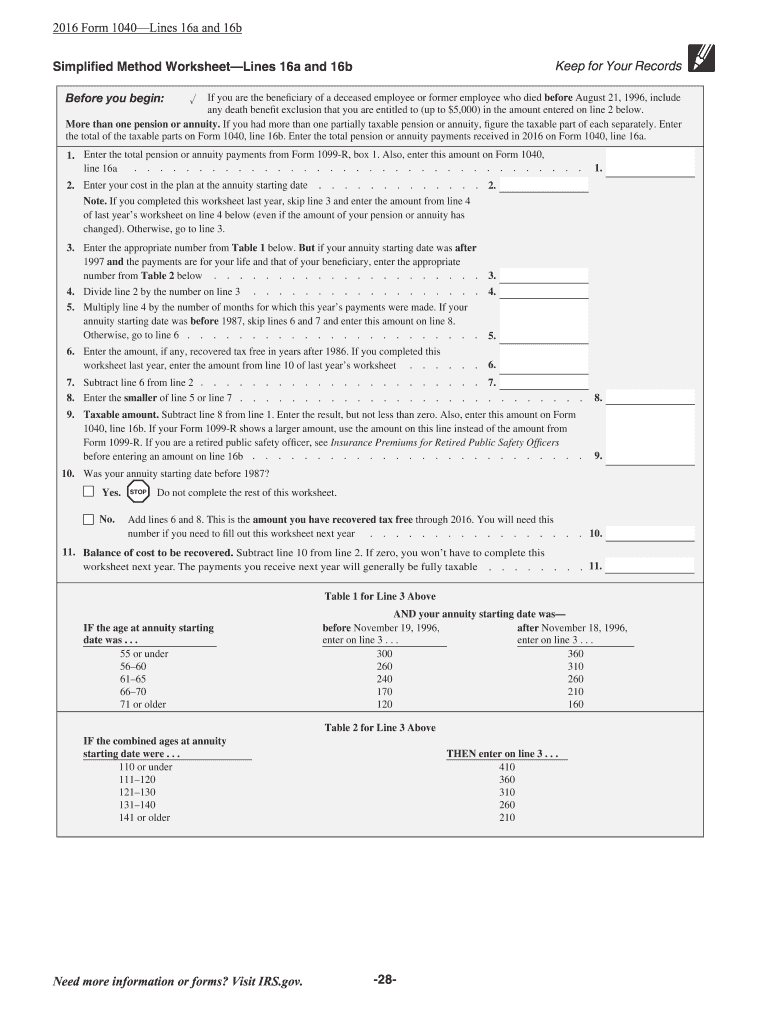

To view this worksheet in a TaxAct Online return. The Simplified Method Worksheet helps you figure the taxable and tax-free parts of your annuity payments each year.

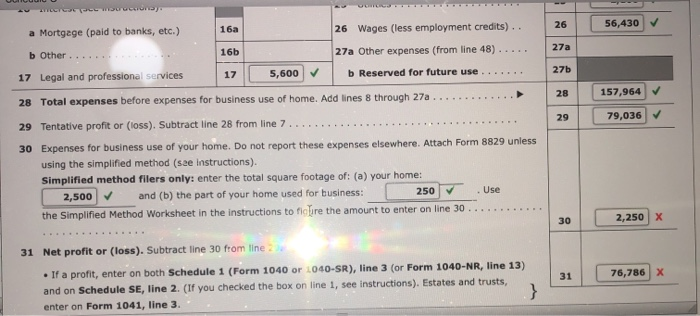

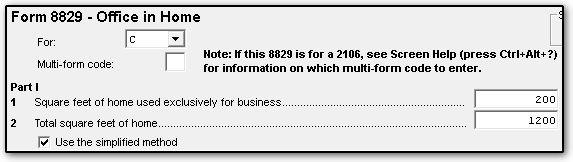

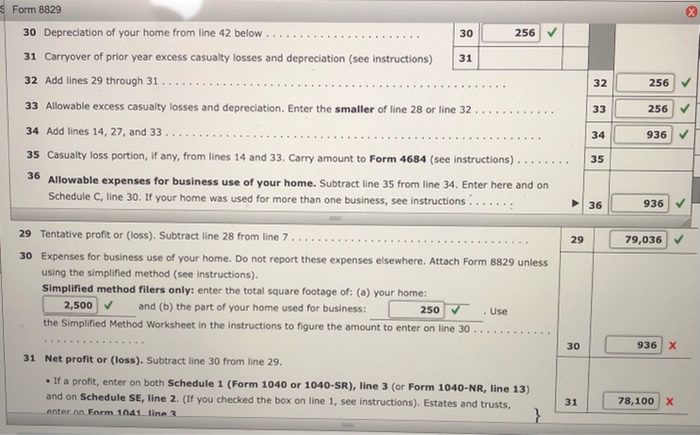

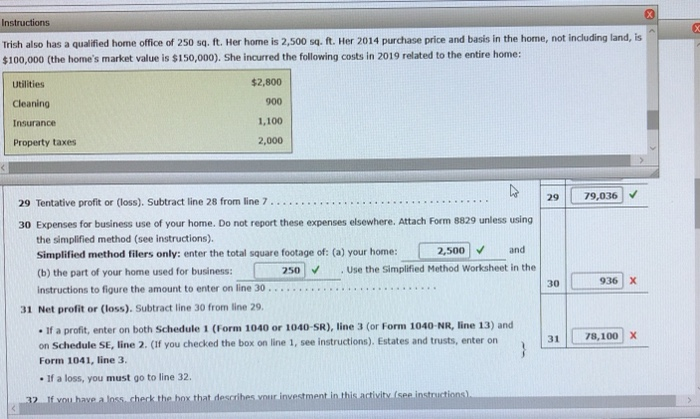

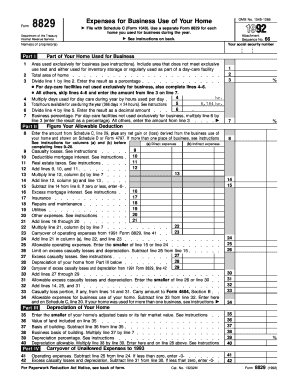

8829 Simplified Method Schedulec Schedulef

Tax Computation Worksheet for Line12a.

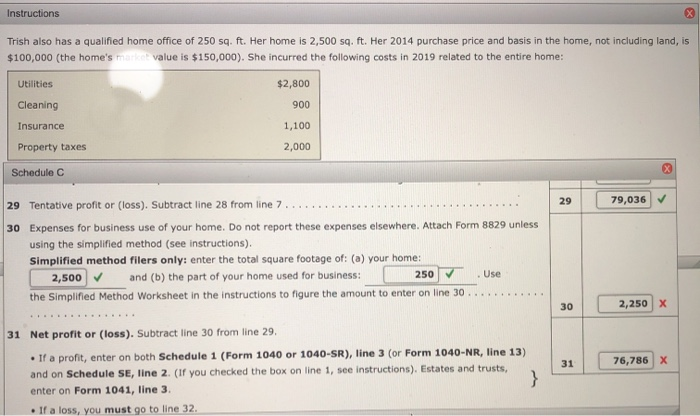

Simplified method worksheet 2019. Epg2 as UPE Unreimbursed Partnership Expenses line 28. Use the SimplifiedMethod Worksheet in the instructions to figure the amount to enter on line 30. Simplified Method Worksheet Lines 4c and 4d.

Student Loan Interest Deduction Worksheet Line 33. How To Get Tax Help. Loans From Qualified Plans.

Also enter this amount on Form 1040 line 4b. Standard numbering on a Form 1099-R. This number will differ depending on whether your annuity starting date is before November 19 1996 or after November 18 1996.

If your annuity starting date was before this year and you completed this worksheet last year skip line 3 and enter the amount from line 4 of last years worksheet on line 4 below even if the amount of your pension or annuity has changed. If you use TaxSlayers simplified method worksheet enter a note with the taxpayers annuity start date age at the start date and amounts. Can I use the Simplified Method.

Social Security Benefits Worksheet Lines 5a 5b. Worksheet last year enter the amount from line 10 of last year s worksheet 6. If Form 1099-R does not show the taxable amount in Box 2a you may need to use the General Rule explained in Publication 575 and Publication 939 to figure the taxable portion to enter on the tax return.

8Enter the smaller of line 5 or line 7 8. Enter the total pension or. Determining the taxable portion of an annuity requires that you determine the amount of your contributions that have been recovered in all prior years so that your exclusion does not exceed your contributions.

Information for Eligible Retirement Plans. Enter the result but not less than zero. Click the checkboxes to the left of what you wish to print the top section contains.

Publication 575 2019 Pension And Annuity Income Internal Revenue Service from wwwirsgov Taxable parts on form 1040 line quick guide on how to complete simplified method worksheet 2020. If the annuity starting date was after July 1 1986 the taxpayer may be required to figure the taxable part of their distribution using the Simplified Method. If you are the beneficiary of a deceased employee or former employee who died before August 21 1996 include any death benefit exclusion that you are entitled to up to 5000 in the amount entered on line 2 below.

Unless using the simplified method see instructions. 31 Net profit or loss. The Simplified Method Worksheet can be found in Form 10401040-SR Instructions if you prefer to do it by hand.

The simplified method worksheet in the taxact program shows the calculation of the taxable amount from entries made in the retirement income section. Repayment of Qualified 2018 and 2019 Distributions for the Purchase or Construction of a Main Home. The Simplified Method Worksheet and when to use it.

And b the part of your home used for business. Schedule F line 32. If the taxable amount isnt calculated in Box 2 the Simplified Method must be used.

Ad The most comprehensive library of free printable worksheets digital games for kids. If the annuity starting date was after July 1 1986 the taxpayer may be required to figure. To use the Simplified Method complete Worksheet A.

Get thousands of teacher-crafted activities that sync up with the school year. Qualified Dividends and Capital Gain Tax Worksheet. If Form 1099-R does not show the taxable amount in Box 2a you may need to use the General Rule explained in Publication 575 and Publication 939 to figure the taxable portion to enter on the tax return.

If you made after-tax contributions to your pension or annuity plan you can exclude part of your pension or annuity payments from your income. Foreign Earned Income Tax Worksheet. The tax-free amount remains the same each year even if the amount of the payment changes.

Ad The most comprehensive library of free printable worksheets digital games for kids. Simplified Method for Pensions and Annuities. Form 2106 line 4.

You cannot use the Simplified Method if you receive your pension or annuity from a non-qualified plan or if you do not meet the conditions described in the Should I use the Simplified Method section. Simplified method filers only. From within your TaxAct Online return click Print Center in the left column.

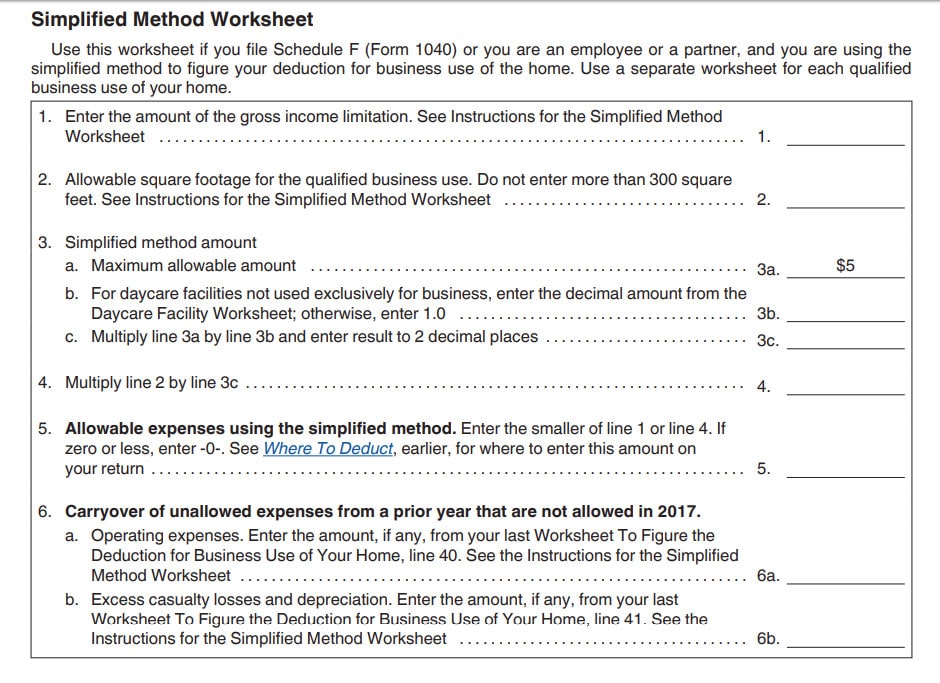

Enter the total square footage of. Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes. The Simplified Method Worksheet in the TaxAct program shows the calculation of the taxable amount from entries made in the retirement income section.

Standard 5 per square foot used to. Get thousands of teacher-crafted activities that sync up with the school year. Subtract line 8 from line 1.

You must figure this tax-free part when the payments first begin. Allowable square footage of home use for business not to exceed 300 square feet Percentage of home used for business. Schedule C line 30.

7Subtract line 6 from line 2 7. The calculation is shown on the Simplified Method Worksheet Form 8829 - Simplified in view mode. In the example above Schedule C displays the calculations on line 30.

Under the Simplified Method you figure the tax-free part of each full monthly annuity payment by dividing the employees cost by a number of months based on your age.

Https Apps Irs Gov App Vita Content Globalmedia 1099r Pension And Annuity Income 4012 Pdf

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

Irs Offers An Easier Way To Deduct Your Home Office Don T Mess With Taxes

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

Simplified Method Worksheet Fill Online Printable Fillable Blank Pdffiller

What Is The Simplified Method Worksheet In The Chegg Com

8829 Simplified Method Schedulec Schedulef

Simplified Method Worksheet Fill Online Printable Fillable Blank Pdffiller

What Is The Simplified Method Worksheet In The Chegg Com

What Is The Simplified Method Worksheet In The Chegg Com

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

Simplified Method Worksheet Fill Online Printable Fillable Blank Pdffiller

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

8829 Simplified Method Schedulec Schedulef

Simplified Home Office Deduction When Does It Benefit Taxpayers

8829 Simplified Method Worksheet Fill Out And Sign Printable Pdf Template Signnow

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

What Is The Simplified Method Worksheet In The Chegg Com

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results