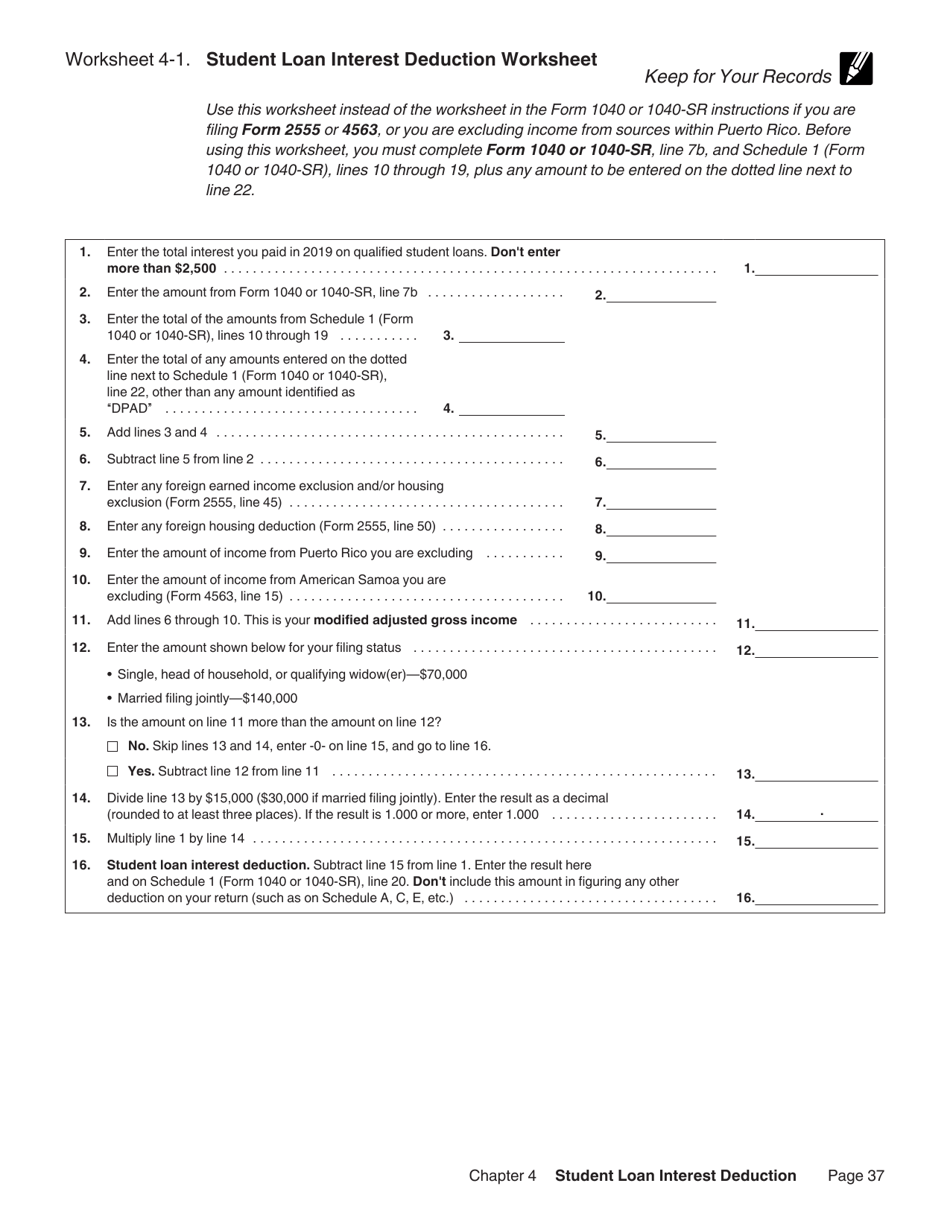

Student Loan Interest Deduction Worksheet 2019

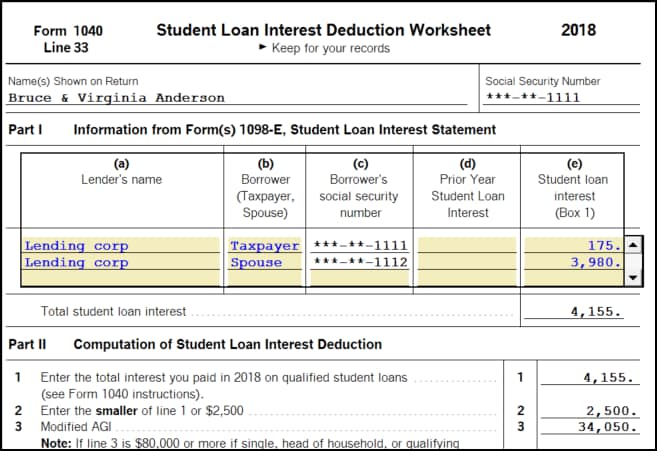

Student loan interest deduction. Do not enter more than 2500.

Newbest Of Self Employed Tax Deductions Worksheet Check More At Https Www Chemistry Worksheets Self Employed Tax Deductions Reading Comprehension Worksheets

If you have qualifying student loan debt you can deduct the interest you paid on the loan during the tax year.

Student loan interest deduction worksheet 2019. The student loan interest deduction allows you to deduct up to 2500 of the interest you paid on a loan for higher education. With a 2500 deduction cap for 2019 its possible to save up to 550 you owe on your taxes or get an additional 550 on your refund. However the amount youll actually save on your taxes depends on your income and whether you can claim the full 2500 student loan interest deduction.

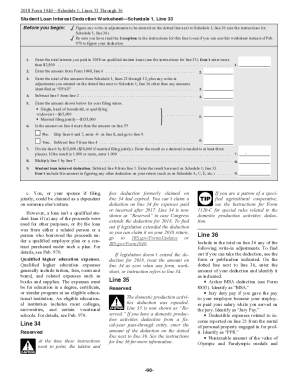

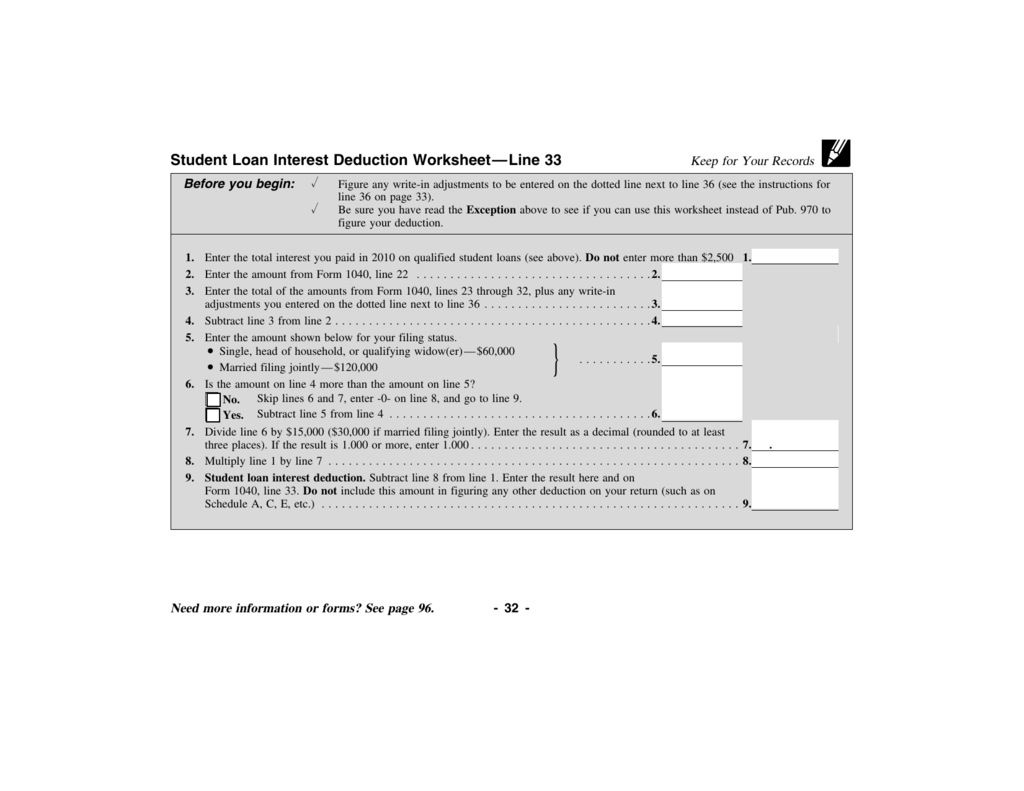

Exception in the instructions for this line to see if you can use this worksheet. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1 line 36 see the instructions for Schedule 1 line 36. It includes both required and voluntarily pre-paid interest payments.

You cant claim the deduction if your MAGI is 85000 or more 170000 or more if you file a joint return. Prepare a Form 1040 Student Loan Interest Deduction Worksheet and a Schedule 1 for Phillip and Barbara. Ad The most comprehensive library of free printable worksheets digital games for kids.

Once you know this youll add your deduction amount to the 1040 Schedule 1 form which is used to determine your AGI. Student loan interest is interest you paid during the year on a qualified student loan. In this case your taxable income is lowered by the amount of student loan interest you paid in 2019 up to 2500.

Because the school was not a Title 4 school I do not receive a 1098-E form. Enter the result here and on Form 1040 line 33 or Form 1040A line 18. Handphone Tablet Desktop Original Size There are various forms of loans and based on the kind is vital to determine is what sort of terms and interest rates are calculated.

For 2020 the amount of your student loan interest de-duction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and 170000 if you file a joint return. Once you have it you can use the student loan interest deduction worksheet to determine whether you qualify for the tax break and how much you can claim. 1545-0074 2019 Attachment Sequence No.

Get thousands of teacher-crafted activities that sync up with the school year. Student Loan Interest Deduction Worksheet. Enter the total interest you paid in 2016 on qualified student loans see instructions.

I have a student loan that I pay which includes interest at 13. Enter the total interest you paid in 2019 on qualified student loans see the instructions for line 20. Go to wwwirsgovForm1040 for instructions and the latest information.

However that bill stalled in the House Committee on Ways and Means. This is capped at 2500 in total interest per return not per person each year. If manually preparing the return the Student Loan Interest Deduction worksheet can be found in IRS Publication 970 Tax Benefits for Education.

Ad The most comprehensive library of free printable worksheets digital games for kids. July 11 2019 DRAFT AS OF SCHEDULE 1 Form 1040 or 1040-SR Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income Attach to Form 1040 or 1040-SR. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year.

The deduction can be claimed. Subtract line 8 from line 1. Do not enter more.

You dont have to fill out a Schedule A. The Student Loan Interest Deduction Act of 2019 aimed to increase the deduction to 5000 or 10000 for married taxpayers filing joint returns when it was introduced to Congress in June 2019. Be sure you have read the.

Student loan interest deduction. Is there some way or some place that I can deduct that interest payment. It can lower your tax bill by as much as 625.

Student Loan Interest Deduction Worksheet 2016 with 43 Great Ira Deduction Worksheet Line 32 Free Worksheets. Student Loan Interest Deduction WorksheetSchedule 1 Line 33. They are entitled to a 500 credit for each child as a qualifying dependent under the new.

Get thousands of teacher-crafted activities that sync up with the school year. Like other tax deductions the student loan interest deduction helps you by reducing how much of your income is taxed.

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Mortgage Insurance Premiums Deduction Worksheet Worksheet List

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

Student Loan Interest Deduction Worksheet 1040a Nidecmege

Student Loan Interest Deduction

Student Loan Interest Deduction Worksheet Publication 970 Download Printable Pdf Templateroller

Student Loan Interest Deduction Worksheet Line 33

Printable Yearly Itemized Tax Deduction Worksheet Fill And Sign Printable Template Online Us Legal Forms

Realtor Tax Deduction Worksheet Promotiontablecovers

2018 Itemized Deduction Worksheet Excel Acquit 2019 Worksheet Template Tips And Reviews

Student Loan Interest Deduction Worksheet Publication 970 Download Printable Pdf Templateroller

Learn How The Student Loan Interest Deduction Works

Student Loan Interest Deduction Worksheet 2020 Fill Online Printable Fillable Blank Pdffiller

Student Loan Interest Deduction Worksheet Line 33

2018 Itemized Deduction Worksheet Excel Acquit 2019 Worksheet Template Tips And Reviews

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

How To Claim Your Student Loan Interest Deduction

How To Enter Student Loan Interest Reported On For Intuit Accountants Community